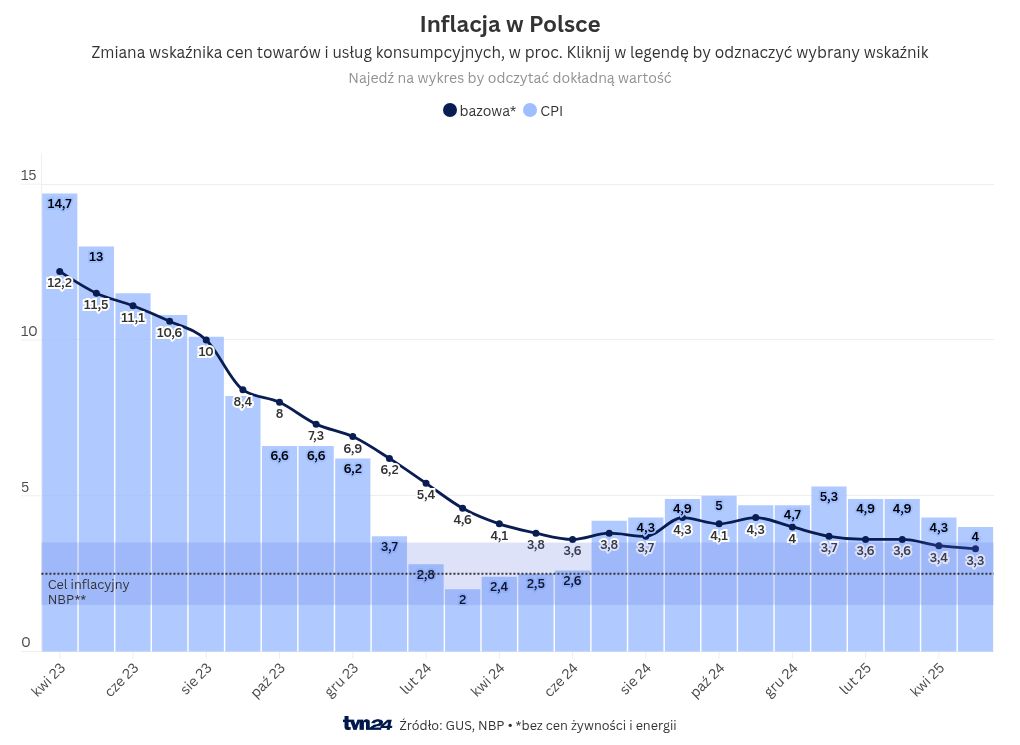

According to a statement from the National Bank of Poland (NBP), core inflation—calculated by excluding food and energy costs—stood at 3.3 percent year-on-year in May 2025. It also noted that the Consumer Price Index (CPI) for goods and services increased by 4.0 percent year-on-year in May.

The NBP indicated that year-on-year inflation rates were as follows: • excluding administered prices (which are controlled by the state) came to -2.5 percent (down from 2.7 percent a month prior); • excluding the most unstable prices, it was recorded at -4.6 percent (down from 4.6 percent a month prior); • excluding food and energy prices, it reached -3.3 percent (down from 3.4 percent a month prior); • the so-called 15 percent trimmed mean, which removes the effects of 15 percent of prices with the lowest and highest volatility, was at -3.8 percent (down from 3.9 percent a month prior).

„Analysts typically rely on the inflation rate that excludes food and energy prices. This indicator reflects the pricing trends of goods and services that are significantly influenced by the monetary policy of the central bank. Energy costs (including fuels) are determined not by domestic dynamics but by global markets, which may also be affected by speculative actions. The pricing of food is largely contingent on various factors, including weather conditions and the existing circumstances in both domestic and international agricultural markets,” the central bank noted in its statement.

The National Bank of Poland highlighted that it assesses four core inflation metrics each month to enhance the understanding of inflationary trends in Poland. The Consumer Price Index (CPI) represents the average price change across a broad array of goods purchased by consumers. When determining core inflation metrics, fluctuations in various segments of this comprehensive basket are examined.

„This approach enables a more precise identification of inflation sources and facilitates more accurate predictions of its forthcoming trends. It also allows for the evaluation of how much of the inflation is persistent and how much is influenced by temporary price shifts resulting from unpredictable factors,” the NBP stated in its announcement.

Twój adres e-mail nie zostanie opublikowany.