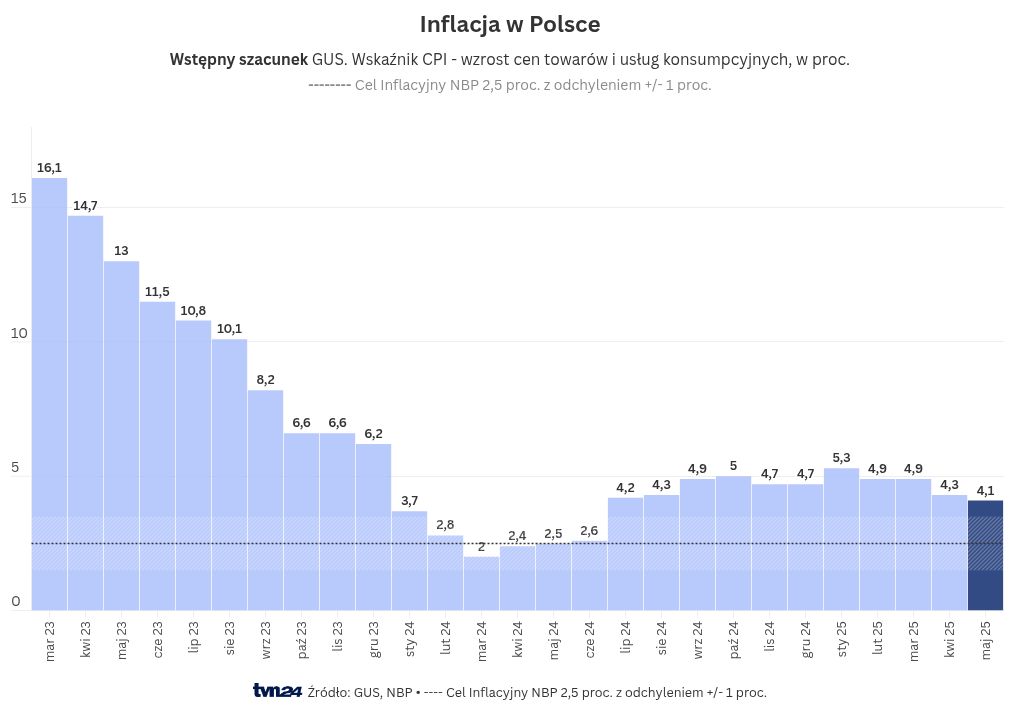

According to the Central Statistical Office (GUS), inflation in May 2025 stood at 4.1 percent year-on-year based on a preliminary estimate. Prices decreased by 0.2 percent compared to the previous month. The Finance Minister stated that the newly announced lower gas tariffs „will contribute to a further decrease in the inflation trajectory in the upcoming months.”

Analysts surveyed by PAP Biznes had anticipated a 4.3% year-on-year increase in prices for May, expecting no month-on-month changes.

On a year-over-year basis, the most significant price hikes were noted for:

energy carriers – increasing by 13.1 percent, and food and non-alcoholic beverages – rising by 5.5 percent.

Conversely, fuel prices for personal transportation dropped by 11.4% in comparison to May 2024.

In the month-to-month comparison (May 2025 against April 2025), the following changes were recorded:

an increase in food and non-alcoholic beverage prices by 0.4 percent, a decrease in energy prices by 0.3 percent, and a reduction in fuel prices by 3.7 percent.

The Central Statistical Office reminds that this preliminary estimate may be revised following the release of final data.

„Inflation has decreased to 4.1% in May and has once again fallen below analysts’ projections. The reduction in gas tariffs will further diminish the inflation trend in the coming months,” the finance minister stated on X.

On Thursday, the Energy Regulatory Office announced the approval of the new PGNiG OD tariff, which will see the gas price decrease from the current PLN 239.65 per MWh to PLN 204.26 per MWh net. This tariff will take effect on July 1, leading to a reduction in gas bills by 8-11 percent based on consumption.

„Inflation in May has shown a downward surprise (we note that such surprises tend to occur cyclically) and has dropped to 4.1%. The key takeaway is the continued decline in core inflation momentum, which is now effectively aligned with the NBP target,” mBank analysts commented.

„CPI inflation in May decreased to 4.1% year-on-year (ING: 4.2%; consensus: 4.3%), and the outlook for further declines is continually improving. The inflation target is nearing, and a significant drop in inflation is expected in July. The Monetary Policy Council has the capacity to act and further lower interest rates,” economists from ING Bank Śląski noted on X.

In a detailed commentary, ING analyst Adam Antoniak indicated that „it appears that core inflation was slightly lower than previously estimated.”

– The lower reading is another piece of encouraging news following yesterday’s decision by the Energy Regulatory Office. The inflation outlook is improving, and we anticipate a sharp decline in inflation in July, particularly as the base effect emerges after last year’s partial deregulation of energy prices and the decrease in gas prices for households, which should further lower inflation by around 0.2-0.3 percentage points year-on-year. Inflation is likely to drop below 3.0% in July, approaching the NBP target, thus creating room for interest rate reductions – the expert elaborated.

– In the base scenario, we expect that in June, the MPC will refrain from making a decision; however, in July – when the new NBP projection is released, showing an overall downward shift in the inflation path – the Council will initiate a cycle of cuts of 25 basis points. We initially anticipate three such moves – in July, September, and November. If inflation declines faster than expected later in the year, an acceleration of the cycle may be on the table – he indicated.

– It is possible that the first move in the cycle, in July, could be more substantial than 25 bp. We still need to analyze more data, but I wouldn’t dismiss such a possibility. While we assume a reduction of 25 bp, a larger cut cannot be ruled out – the expert added.

„CPI inflation may not be plummeting rapidly, but it continues to surprise with a more significant than anticipated rate of decline. According to the preliminary estimate, CPI inflation fell to 4.1% y/y in May (we projected 4.2%, consensus 4.3%). Month-on-month prices decreased by 0.2%. Core inflation

Twój adres e-mail nie zostanie opublikowany.