Biznes Fakty

Dark clouds loom over the budget bill. „Why such a jump?”

According to economists from Bank Pekao, the execution of this year’s budget remains feasible, although the likelihood of needing to amend the budget act has increased, as stated in their commentary on Monday.

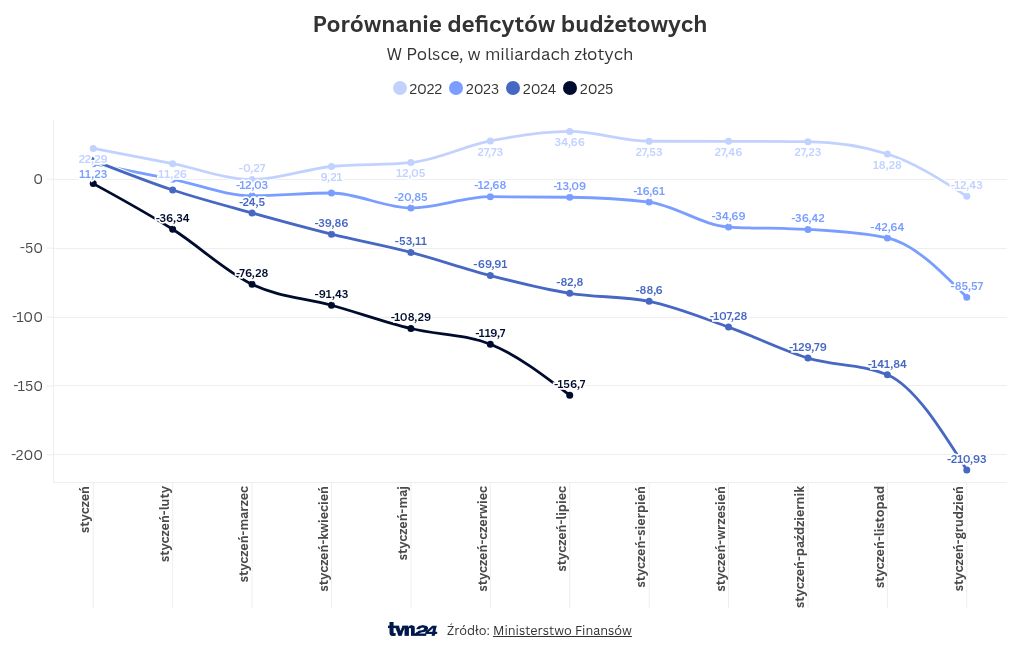

The Ministry of Finance disclosed data on budget execution for July. The figures indicate that after seven months of this year, budget revenues totaled PLN 313.8 billion, equating to 49.6% of the 2025 target, while state budget expenditures during this timeframe reached PLN 470.5 billion, or 51.1% of the plan. The deficit stood at PLN 156.7 billion, representing 54.3% of the annual target.

Increase in Deficit

„In July, the state budget deficit amounted to PLN 37 billion, and for the last 12 months, it has already reached PLN 285 billion, which is nearly exactly what the budget act anticipates for the entire 2025 (PLN 289 billion). This suggests that by year-end, the Ministry of Finance may still incur a deficit of around PLN 130 billion, similar to the last five months of the previous year. While this figure may seem substantial at first glance, it’s important to note that the deficit does not increase uniformly throughout the year, but is typically concentrated in the last two months,” commented economists from Bank Pekao on Monday.

They believe that the Ministry of Finance’s flexibility is currently quite constrained. „While in June we could still maintain optimism regarding the avoidance of budget amendments, following July, we are no longer as confident,” they added.

Reasons Behind Spending Surge

They also noted that the level of expenditures in July was unexpectedly high. In that month alone, the budget expended a staggering PLN 86.6 billion, which is 32 percent more than in July of the previous year and PLN 23 billion above the average monthly expenditure in the first half of 2025, according to the economists.

„What accounts for this sudden increase? It is primarily due to the repayment of maturing BGK bonds amounting to PLN 16 billion, which were issued during the pandemic for the COVID-19 Countermeasures Fund. This marks the second such action taken by the Ministry of Finance this year. In March, it repaid PFR bonds for PLN 19 billion, issued for the Financial Shield. This action by the Ministry was previously announced and is logical, as the costs of refinancing these bonds through BGK or PFR would be higher than through the state budget,” the Pekao economists highlighted.

They stressed that this is a „fully managed process” and noted that it „should not be viewed as a cause or indicator of worsening state finances.”

Minister of Finance and Economy Andrzej Domański PAP/Paweł Supernak

Minister of Finance and Economy Andrzej Domański PAP/Paweł SupernakIssues with VAT and Excise Tax

„However, the developments regarding budget revenue are more concerning. Almost all tax revenues fell short of expectations. VAT revenues in July were merely 1% higher than last year, which is not only slower than in previous months (+20% in May) but also significantly lagging behind the nominal growth in consumption this year. The same trend is observed in excise tax revenues, which in July were 1% lower than a year ago. We will omit the analysis of PIT revenues as it is distorted by the effects of the local government financing reform. The only positive aspect in July was CIT revenues, which reached a respectable PLN 4 billion for this time of year. However, the overall picture remains negative after July,” the commentary stated.

The bank’s economists observed that indirect tax revenues are losing the solid momentum seen at the beginning of the year, although income tax revenues are gaining speed. Nevertheless, they believe this acceleration will not be sufficient to meet the increasing spending demands of the budget.

„In conclusion, while the execution of this year’s budget is still feasible, the Ministry of Finance’s room for maneuver has considerably narrowed, and the probability of needing to amend the budget law has escalated. This will exert pressure on Treasury bond yields until the year’s end,” noted the experts from Bank Pekao.