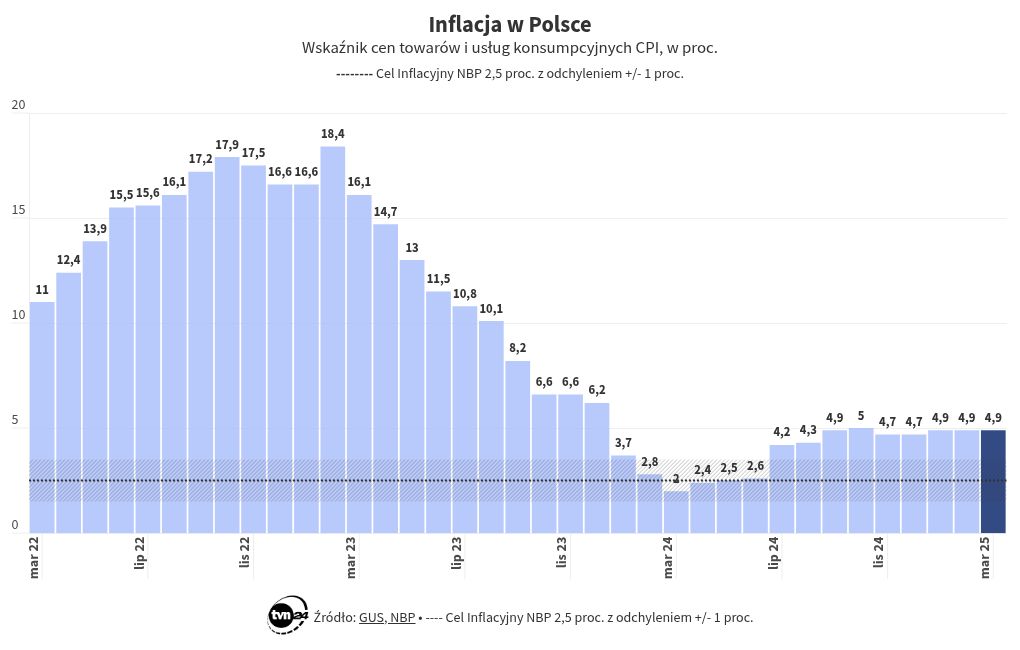

In March 2025, consumer goods and services prices rose by 4.9 percent compared to the previous year, as reported by the Central Statistical Office (GUS). In relation to the prior month, inflation was recorded at 0.2 percent.

Previously, a preliminary estimate from the Central Statistical Office indicated that CPI inflation for March was 4.9% year-on-year and 0.1% month-on-month.

The report noted that in March 2025, the cost of services went up by 6.4% year-on-year, while the prices of goods increased by 4.4% year-on-year.

Significant price hikes were seen in the following areas: – housing and energy carriers – with an increase of +10.9 percent year-on-year, – education – with an increase of +8.2 percent year-on-year, – food and non-alcoholic beverages – with an increase of +6.7 percent year-on-year.

Price reductions occurred in two categories: – transportation – down by -3.6% year-on-year, – clothing and footwear – down by -1.3% year-on-year.

„March’s inflation confirmed at 4.9% year-on-year. Instead of reaching a peak, we observed a plateau, with core inflation decreasing in the first quarter of 2025 (approximately 3.6% in March). The improving outlook for inflation is a key factor influencing the MPC’s position, which may lead to a rate cut of 50 basis points as early as May,” stated economists from ING Bank Śląski.

„It is highly unlikely we will see a five-pointer in 2025. Additionally, the monthly price growth has been revised to 0.2% from the initial estimate of 0.1%. Services inflation eased to 6.4% year-on-year from 6.6% year-on-year in February, while goods inflation slightly accelerated to 4.4% year-on-year from 4.3% year-on-year. We estimate that core inflation has returned to the range of deviations from the NBP inflation target for the first time since mid-2021,” noted analysts from PKO BP.

mBank economists emphasized that „it truly has no practical impact on monetary policy whether inflation is at 4.9%, 5% or 5.1% at its highest point.”

„The crucial aspect is the considerable discrepancy from the MPC’s projections and what is revealed in the details, particularly in inflation momentum. And there, everything is falling apart,” they highlighted.

They further added: „We are among the last to criticize the NBP’s projections. These are projections, not forecasts. They help us evaluate the effects of current monetary policy. The divergence is what determines how we can consider recalibrating monetary policy parameters to meet the target.”

Twój adres e-mail nie zostanie opublikowany.