Biznes Fakty

Interest rates and inflation. NBP President Adam Glapiński on the MPC decision

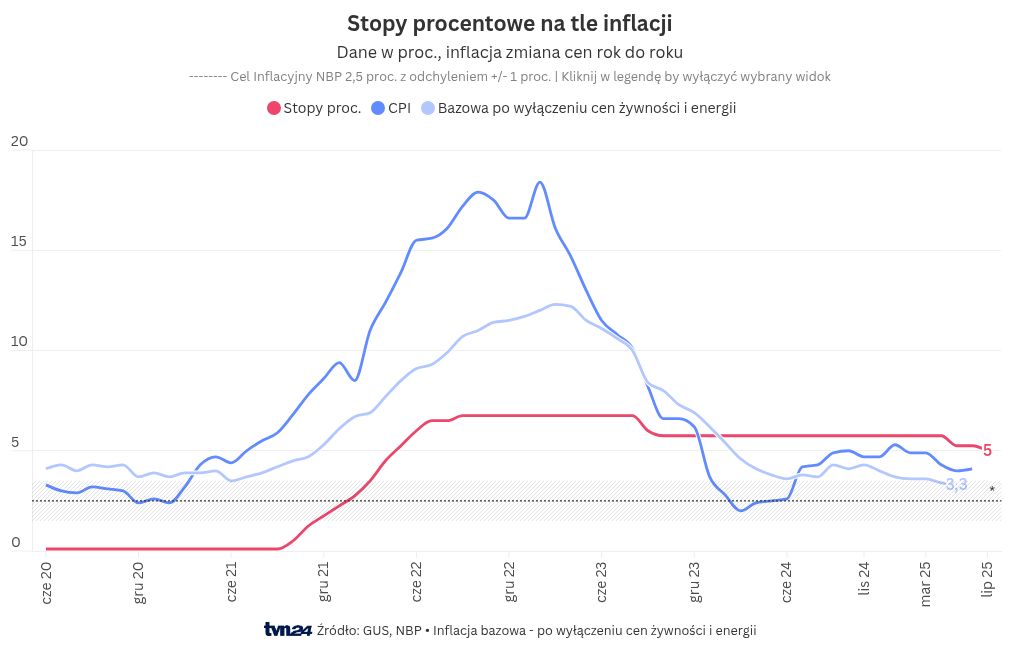

In the upcoming quarters, inflation could experience a slight uptick due to the unfreezing of energy prices, stated Adam Glapiński, the president of the National Bank of Poland. He further noted that, depending on positive data, a decrease in interest rates in September could be on the table.

During a press conference on Thursday, NBP President Adam Glapiński remarked that „inflation may see a minor increase in the forthcoming quarters as a consequence of the unfreezing of energy prices.”

Glapiński on inflation in Poland

– The situation is once again uncertain, as the Sejm is currently reviewing the so-called wind farm act, which includes clauses regarding the continued freezing of electricity prices; however, the final form of this legislation remains uncertain – he explained.

At the same time, Glapiński pointed out that if the Senate approves the legislation, it remains unclear whether the president will sign it. – As you know, there was an unfortunate linkage of this wind farm legislation with the freezing of energy prices – he added. – It’s not our responsibility, but we are awaiting the outcome – he stressed.

– Importantly, however, projections indicate that inflation will align with the NBP’s inflation target in the so-called medium term – the NBP president added.

According to the Monetary Policy Assumptions prepared by the Monetary Policy Council, the NBP aims to keep inflation – defined as the annual percentage change in the consumer price index – at 2.5% with a symmetrical deviation range of +/- one percentage point in the medium term.

NBP President on the Monetary Policy Council’s decision regarding interest rates

The Monetary Policy Council (MPC) concluded a two-day meeting on Wednesday, during which it decided to lower interest rates by 25 basis points. This decision means that the main interest rate, the reference rate, is now 5 percent annually. The Lombard rate will be 5.50 percent annually, the deposit rate 4.50 percent, the bill rediscount rate 5.05 percent, and the bill discount rate 5.10 percent annually.

The NBP President indicated that the interest rate reduction in July is not the commencement of a new cycle, and the Monetary Policy Council will make decisions based on incoming information.

– Indeed, following the prior Council (MPC meeting – editor’s note), it was largely evident from discussions that most Council members believed they would lower (interest rates – editor’s note) after the summer break, in September, in the fall. However, the incoming data proved to be significantly better than anticipated, regarding wage dynamics and inflation trends. This encouraged us not to postpone this decision – stated NBP President Adam Glapiński.

When queried by reporters whether a cut would happen in September, he responded that if „the conditions are favorable,” there are „no obstacles” to this.

Glapiński emphasized that there will be no Council meeting in August during the holidays. He mentioned that it would be unacceptable for the NBP to meet its inflation target in August without the MPC reacting. – I suspect (…) that had there been a decision-making meeting in August, this (July) reduction may not have occurred – he remarked.

– If inflation in our country stays at 2.5 percent, interest rates will also decline to a similar level, but these rates are not high. We are primarily aiming to maintain rates that exert an anti-inflationary effect without being excessively high or inhibiting the economy. Our focus is on the economy’s well-being, even though our main task is to curb inflation – stated Glapiński.

– Fortunately, the current economic cycle and trend in inflation processes suggest that interest rates are decreasing and will likely continue to lower if there isn’t an unexpected spike in inflation, which is challenging to foresee. At this moment, I don’t perceive any reason for such a scenario, but forecasting remains difficult – he added.

Price Freeze and Windmill Act

Last week, the Sejm approved an amendment to the so-called windmill act, which among other things, reduces the minimum distance between wind turbines and buildings to 500 m. This act also includes provisions for the freezing of energy prices at PLN 500 net per MWh until the year’s end. Currently, this freeze is in effect until the end of September this year.

The amendment facilitates the construction of wind farms by establishing a so-called participation fund for residents near future wind farms. During the second reading in the Sejm, an amendment labeled Poland 2050 was introduced, which proposes extending the freeze on electricity prices for households until the fourth quarter of 2025. According to existing regulations, the price frozen at PLN 500 per MWh net is valid until September 30. The Senate still needs to address the act.