Biznes Fakty

The government's huge problem. „We need to sound the alarm”

Spending on public debt servicing has escalated to an all-time high – observes „Rzeczpospolita”. The escalating expenses are attributed to national politics, which is marked by an ongoing election campaign and heightened social expenditures.

The expenses associated with public debt servicing have surged to unprecedented levels. Analysts indicate that the rise in social expenditures stems from the continuous election campaign – reports Thursday’s „Rzeczpospolita”.

Rising debt service costs

According to the newspaper, the expenditure for debt servicing, primarily the interest disbursed to treasury bond holders, is projected to be approximately PLN 80.2 billion for the entire public finance sector in 2024 – based on Eurostat data. This represents a 13 percent increase compared to 2023, and is 2.5 times higher than prior to the pandemic or the initiation of the conflict in Ukraine. In 2019 or even 2021, Poland’s debt servicing amounted to PLN 30 billion.

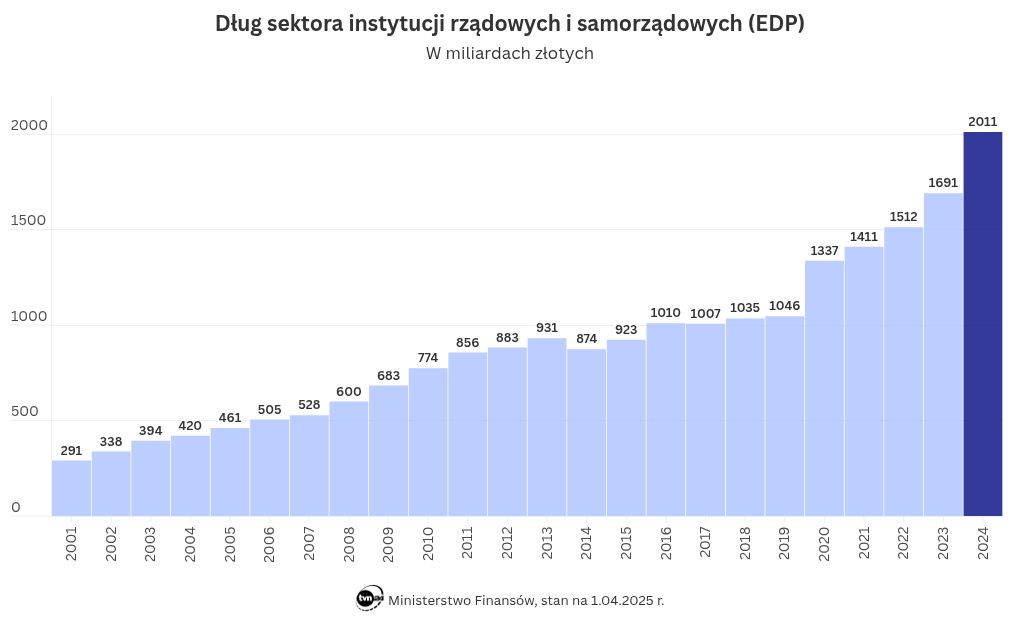

„This significant rise is chiefly due to the rapid growth of public finance debt. By the end of 2024, our debt is expected to surpass PLN 2 trillion. This is PLN 320 billion more than the previous year and nearly PLN 970 billion higher than five years ago,” the newspaper states.

– Numerous factors are exerting pressure on the state’s finances – clarifies Piotr Bujak, chief economist at PKO BP, in an interview with the publication.

„The debt is increasing, partly due to the necessity for substantial spending on defense and to alleviate the impacts of the energy crisis, which has persisted since the onset of Russian aggression against Ukraine. Furthermore, a certain fiscal effort is essential to fully leverage EU funds, and the ongoing election campaign, which has been nearly constant for several years, has led to heightened social spending,” the article states.

– All of this is compounded by a considerable rise in interest rates, which has further escalated the costs of debt servicing – underscores Piotr Bujak.

„It is important to mention that while from mid-2019 to mid-2021, the yield on ten-year Treasury bonds was below 2 percent, it currently hovers around 5.5 percent,” the article notes.

As „Rzeczpospolita” highlights, „the PLN 80 billion in interest paid in nominal terms is quite striking.” The daily also points out that the state spends significantly less on its largest social program, the 800 plus initiative, which costs PLN 65 billion.

„This is irreconcilable”

„Rzeczpospolita” recalls that government projections indicate that public debt (calculated according to EU standards) is anticipated to grow in both nominal and real terms in the coming years, exceeding the 60 percent GDP threshold as early as 2026.

– The rationale for surpassing the debt limit will be attributed to the repercussions of the war and the pandemic; however, in my view, this cannot continue without significant alterations in public finance priorities – stresses Rafał Benecki.

– We either incur massive expenses related to broadly defined security or on so-called social welfare. These two aspects cannot coexist. We must raise the alarm now because, in the current election campaign, neither politicians nor society demonstrates any willingness to address the issue of accountability for the public finance situation – evaluates the chief economist of ING Bank Śląski.