Biznes Fakty

Core inflation – February 2025. NBP data

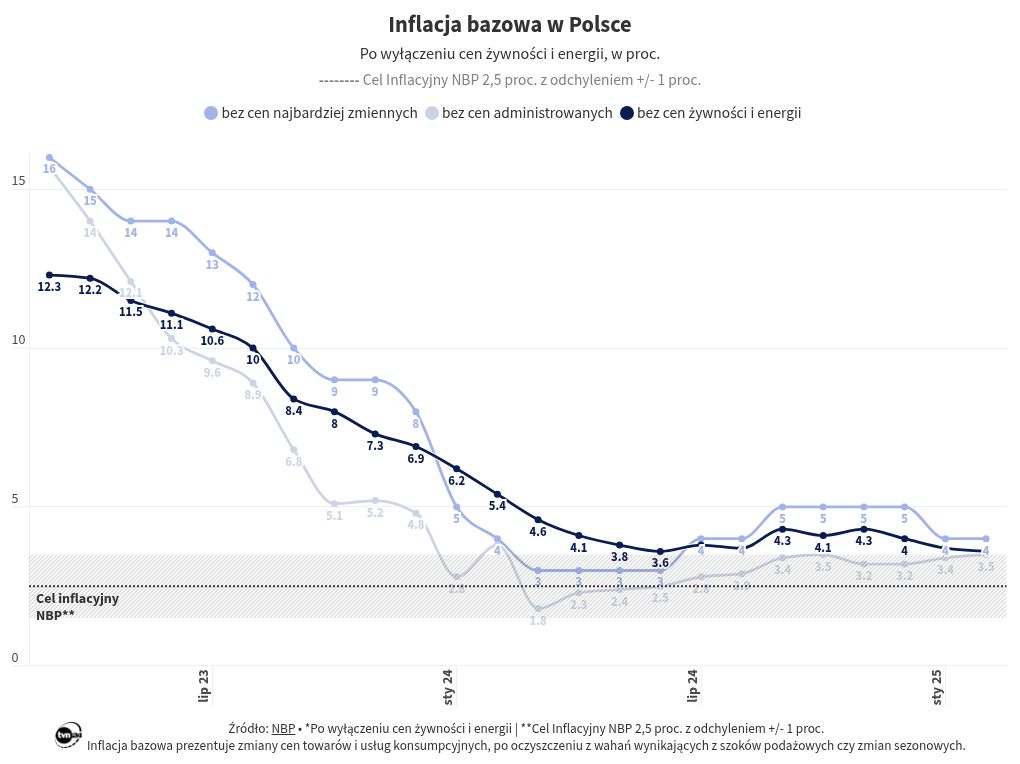

The National Bank of Poland has reported that core inflation, which excludes food and energy prices, was at 3.6 percent year-on-year in February 2025. This is a slight decrease from 3.7 percent recorded in January.

On Monday, the National Bank of Poland released figures regarding core inflation for February 2025. The data indicates that core inflation, which excludes administered prices (those regulated by the government), stood at 3.5 percent, up from 3.4 percent the previous month. Additionally, core inflation, which disregards the most volatile prices, was 4.9 percent, compared to 4.8 percent a month earlier. Core inflation, after excluding food and energy prices, was 3.6 percent, down from 3.7 percent in January.

The NBP noted that the so-called 15% trimmed mean, which removes the effects of the 15% of prices with the lowest and highest fluctuations, reached 4.6%, an increase from 4.4% the previous month.

Core inflation calculated by the NBP

„Each month, the National Bank of Poland computes four core inflation indices, which aids in understanding the characteristics of inflation in Poland. The CPI reflects the average price changes across a broad basket of goods purchased by consumers. In assessing core inflation indices, we analyze price changes across various segments of this basket. This method facilitates a clearer identification of inflation sources and enables more precise predictions of future trends. It also helps determine the extent to which inflation is persistent versus influenced by temporary price fluctuations from unpredictable factors,” stated the NBP in their announcement. In February, consumer inflation, as calculated by the Central Statistical Office, was 4.9 percent, consistent with January’s figure. ” The most frequently utilized metric by analysts is the inflation rate excluding food and energy prices. This reflects the pricing trends of goods and services that are significantly impacted by the monetary policy implemented by the central bank. Energy prices (including fuels) are influenced not by the domestic market but rather by global markets, which can also be affected by speculation. Food prices are largely dependent on factors such as weather conditions and the current status of both domestic and global agricultural markets,” the central bank reported.