Biznes Fakty

Interest rate forecasts. When will the next interest rate cut be? MPC member Ludwik Kotecki comments

– Trump has assumed the role of the eleventh member of the Monetary Policy Council, as his actions are significantly benefiting us. Specifically, through the influence of his decision announcements on commodity prices – stated Ludwik Kotecki, a member of the Monetary Policy Council, during an appearance on TVN24 BiS. At present, the reference rate remains at 5.25 percent. Kotecki indicated when the subsequent rate reduction might be anticipated.

Ludwik Kotecki, a member of the Monetary Policy Council (MPC), when questioned on TVN24 BiS about the repercussions of the trade war initiated by US President Donald Trump, which is currently paused, on inflation in Poland, responded that „it actually helps us a lot.”

– Trump has become the eleventh member of the Monetary Policy Council, because his actions are genuinely assisting us significantly. Specifically through the influence of his decisions, or rather the announcements of those decisions, on the prices of raw materials, for instance. They have declined as a consequence of Trump’s announcements negatively affecting global economic growth, hence these prices should not rise here due to a lack of justification – explained Kotecki.

When is the next interest rate cut?

Kotecki, when asked about the likelihood of further interest rate reductions, mentioned that there is potential for that. He pointed out that after considering factors that „we have no control over,” such as global armed conflicts, there is indeed room for rate cuts.

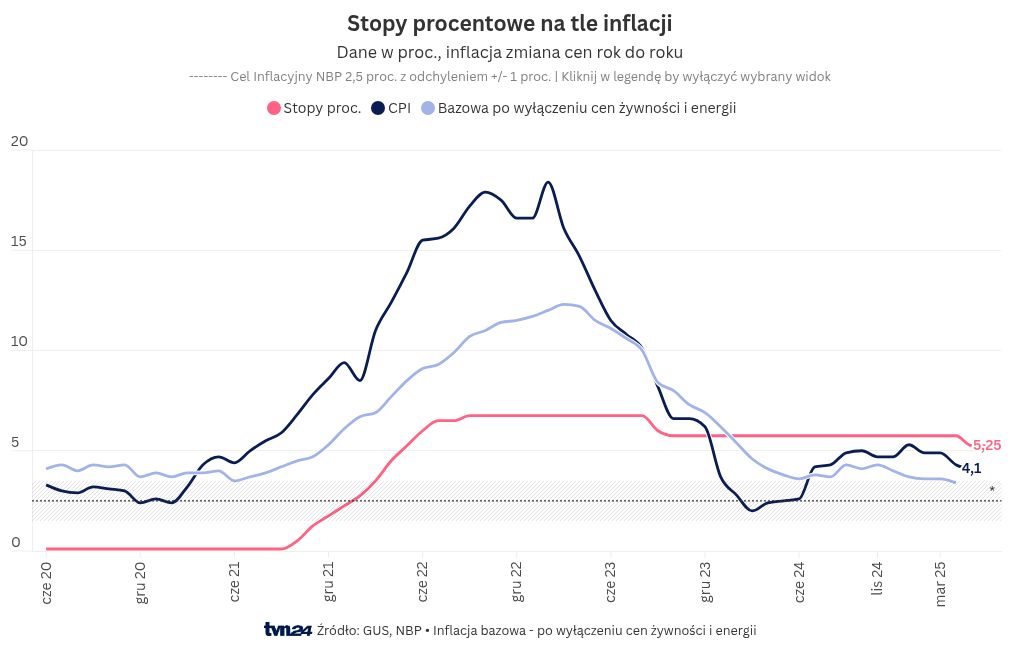

– Inflation appears to be surprisingly swiftly returning to the target level, which is 2.5 percent. In fact, this year, each successive month brings certain unexpected developments. The situation is better than economists and analysts anticipated. Currently, inflation stands at 4 percent, according to the consumer price index. This base (…) has already dropped below 3.5 percent – noted the MPC member.

Kotecki indicated that inflation is expected to decline in July. – The consumer price index, which is released by the Central Statistical Office (…) will fall considerably below 3 percent. Additionally, core inflation will continue to decrease, as this is also occurring in some parallel context – he remarked. – In light of this (…), it appears that this space is already available and will continue to be. In the second half of the year, I would anticipate the Monetary Policy Council to lower interest rates responsibly by at least 50 basis points – stated the economist.

Kotecki mentioned that the likelihood of a rate cut in July is „below 50 percent”.

– This is because the Council will likely want to wait for the budget proposal and will probably want to wait for the new electricity tariffs, which are not expected to be known until August. Therefore, if not in July, I believe we will certainly lower these rates in September, unless something unpredictable occurs that we cannot foresee or even contemplate – remarked the guest of TVN24 BiS.

However, he added that a surprise in July cannot be excluded due to the inflation forecast. – If the inflation forecast indicates that we are quickly returning to the target level, there would be no reason to delay this decision. Even until September – he noted.

Lower interest rates and inflation. Arguments and counterarguments

Kotecki, when asked about the risk factors that NBP President Adam Glapiński discussed at his conferences, and whether he concurred with them, stated that „I have more counterarguments than arguments similar to those of the president”.

– Firstly, the economy is growing more slowly than its so-called potential, which indicates a so-called negative demand gap, meaning there is no demand pressure in such an economy, and consequently, no pressure to increase prices. This likely explains the quicker decrease in inflation than we anticipated – he responded to one of the NBP president’s points.

He also mentioned that, based on statements from, among others, representatives of the Energy Regulatory Office, he did not foresee an increase in electricity prices in October after the unfreezing of prices, which had raised President Glapiński’s concerns.

– Despite the unfreezing, we will see household prices remaining at their current levels, and perhaps even – as stated by the Minister of Finance last week – those prices may actually be lower than they are now. Thus, there will not only be no inflationary impetus but rather a disinflationary one – said Kotecki.

As a third counterargument regarding inflation and maintaining interest rates, the Council member brought up the budget.

– I would expect that next year’s budget deficit will be lower than this year’s. This means that this year we will have a deficit that is less than last year’s, and next year will be lower than this year. It probably won’t be much lower, but it will be lower. Therefore, these conditions will be more favorable for reducing inflation than unfavorable – he explained.

Finally, he emphasized that „all global factors

Źródło