Biznes Fakty

Interest rates in Poland. Marek Belka: let's just do it

Should the Monetary Policy Council consider decreasing interest rates? – It is essential to acknowledge the reality. Inflationary pressures in Poland have been diminishing for several months, thus monetary policy should be eased – stated Professor Marek Belka, former prime minister and ex-head of the National Bank of Poland during the program „Rozmowa Piaseckiego”.

The former president of the National Bank of Poland expressed in „Rozmowa Piaseckiego” that the Monetary Policy Council ought to „acknowledge the realities”.

– Inflationary pressures in Poland are subsiding and have been for several months (…), hence, monetary policy should be relaxed. I believe, as has been the case in recent years, there will be a delay. Let’s proceed with it – he remarked.

Belka: inflationary pressures are subsiding

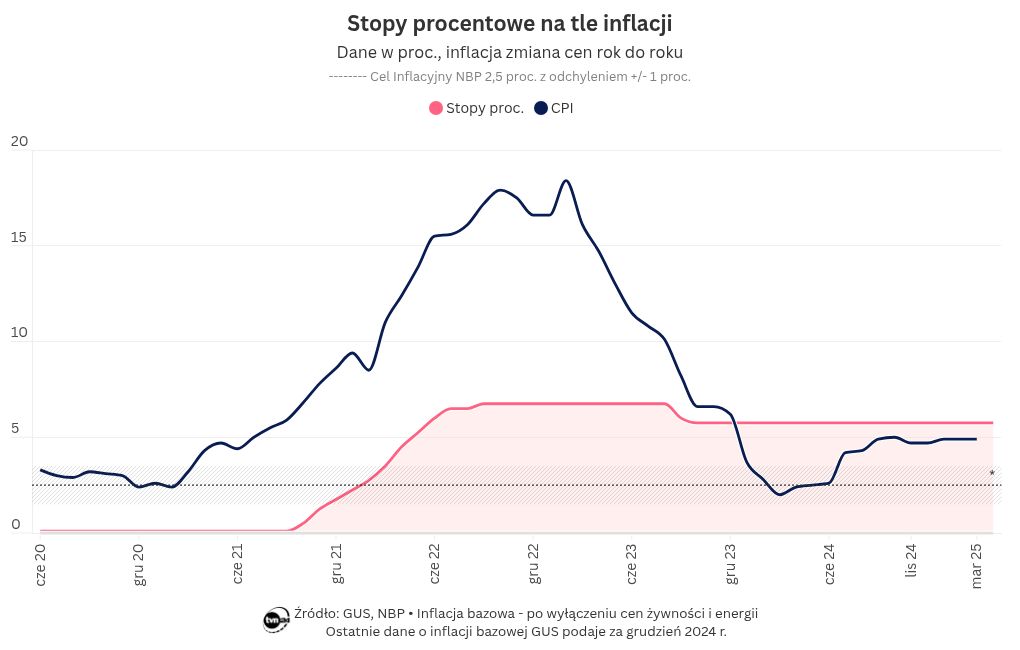

When asked if a reduction in interest rates would trigger inflation to rise again to 6-8 percent, Prof. Belka noted that „core inflation, which is influenced by monetary policy, is already at 3.5 percent.”

– Thus, we can essentially say that it is nearly at the central bank’s inflation target. Moreover, monetary policy impacts the economic situation with a significant delay, typically between 6 to 8 quarters, or so theory suggests. Perhaps a bit quicker. Thirdly, we examine inflation year over year, while I analyze inflation month by month. Recently, this inflation has been remarkably low – 0, 0.1, 0.2 percent. This is what I refer to when I indicate that inflationary pressure is easing – stated the former NBP president.

When queried about the influence of political calls for lower interest rates on the NBP’s decision-making, Marek Belka mentioned that he „wants to avoid delving into purely political matters in this conversation.”

– I believe that the involvement of the National Bank of Poland in current political affairs is quite detrimental – he concluded.

Glapiński on interest rates

During a press conference last week, the NBP President indicated that there might be potential for reducing interest rates in the near future. The leader of the central bank remarked that „the stance of the Monetary Policy Council has fundamentally shifted” concerning monetary policy. Simultaneously, he pointed out that this does not imply a commitment to beginning a cycle of rate reductions or a one-time adjustment.

Adam Glapiński assessed that a decrease in interest rates could take place in May or any subsequent month.

– It could happen in May, it could occur in June, it could happen in July. (…) We as the Monetary Policy Council make decisions based on incoming data and ongoing analyses – he stated.

Interest rates in Poland

At its meeting that concluded on Wednesday, the Monetary Policy Council decided to maintain the interest rates of the National Bank of Poland unchanged. The main interest rate of the NBP, the reference rate, remains at 5.75%.

The Monetary Policy Council last modified interest rates in October 2023. At that time, it reduced the NBP rates by 25 basis points to their current level.