Biznes Fakty

Mortgages are cheaper in September. Interest rates are down, and installments are lower.

Borrowers can expect some relief. Decreased interest rates result in lower monthly payments, improved creditworthiness, and actual savings of up to several hundred zlotys each month, as analyzed by Jarosław Sadowski, head of the analysis department at Rankomat.pl.

September holds particular importance regarding monetary policy and interest rates. Jarosław Sadowski, director of the analysis department at Rankomat.pl, highlights that it has been three years since the Monetary Policy Council increased the reference rate to 6.75 percent—the peak of that cycle.

The Monetary Policy Council has made a decision regarding interest rates . PAP

The Monetary Policy Council has made a decision regarding interest rates . PAPSadowski on loan payments

„This elevated level resulted from extremely high inflation, which reached a peak of 17 percent year-on-year,” Sadowski remarks. A series of interest rate reductions commenced two years ago, leading to five cuts in total, lowering the reference rate by 2 percentage points—from 6.75 percent to 4.75 percent.

The 3M WIBOR rate experienced an even more pronounced decline, falling from 7.61% to 4.82%, a drop of 2.79 percentage points. „This notable disparity arises because in November 2022, the market anticipated additional rate hikes, whereas it now expects further reductions. Consequently, changes in WIBOR are more pronounced than those in the reference rate,” the expert clarifies.

The reduction in WIBOR directly affects loan payments. The expert points out that an individual who secured a PLN 500,000 loan for 30 years at a 3M WIBOR rate of 7.61% initially paid an installment of PLN 4,281. Currently, their payment has decreased to PLN 3,300, reflecting a reduction of PLN 981. These calculations pertain to variable-rate loans and assume that the bank promptly adjusts the interest rate. Sadowski notes that, in practice, the adjustment may take time—banks typically update interest rates every three months (3M WIBOR) or every six months (6M WIBOR), and the lower payment is generally realized one month after the update.

Read more: Today’s crucial decision for borrowers. „Room for further easing” >>>

What about fixed-rate loans?

Sadowski also emphasizes the scenario with fixed-rate loans. For loans currently being repaid, the interest rate transitions to a variable or lower fixed rate only after the fixed-rate term concludes—typically five years. An exception exists for transferring a loan to another bank, which permits a new, lower fixed rate. However, this approach does not convert the fixed rate into a variable rate.

For newly issued fixed-rate loans, the rates can change at any moment. Their levels are influenced by banks’ projections for interest rates over the next five years. As Sadowski indicates, the current average interest rate, with a down payment exceeding 20%, stands at 6.22%. Earlier this year, it was 7.35%, marking a decrease of 1.13 percentage points, significantly surpassing the NBP rate reductions at that time. This occurs because fixed interest rates are applicable for five years, meaning banks already consider potential future reductions.

Conversely, the average for variable interest rates is 6.9%. For them to become more advantageous than fixed rates, they must decrease by at least 0.67 percentage points.

Increased creditworthiness

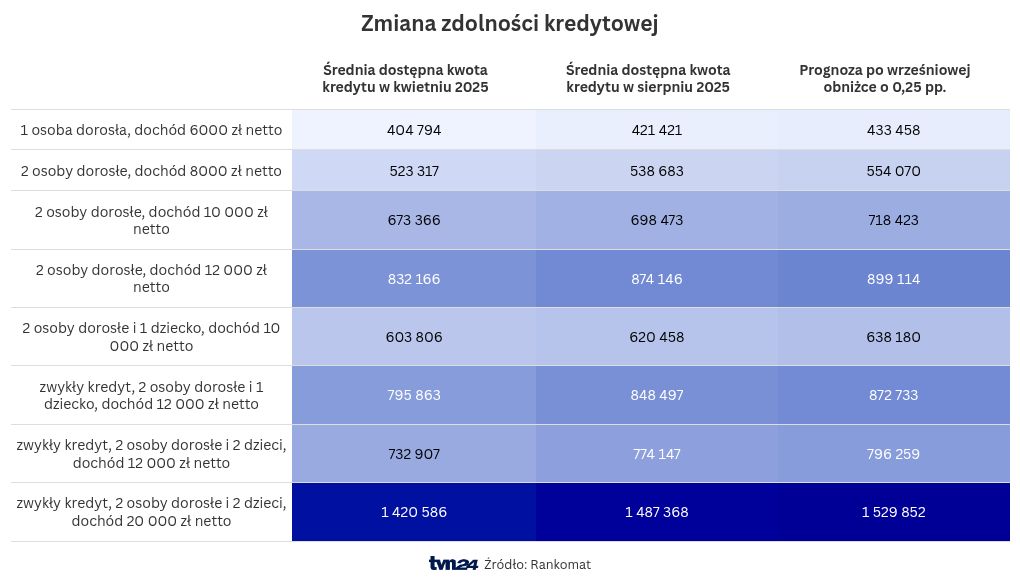

Lastly, the expert highlights the rising creditworthiness. „Interest rate reductions have substantially enhanced it. For instance, for a family with one child and a net income of PLN 12,000, the average loan amount available rose from PLN 795,000 to PLN 848,000 between April and August. This represents a 6.6 percent increase,” says Sadowski. For families with more children or lower incomes, the increases tend to be smaller, ranging from 3 to 5 percent.