Biznes Fakty

Saving. Most Poles don't have enough money saved to survive for more than a month.

A total of 83 percent of Poles have some form of savings. Nonetheless, these amounts are often so limited that one-third of individuals could only sustain themselves for a maximum of one month. According to the research titled „Scale and Goals of Savings Accumulated by Poles,” commissioned by the BIG InfoMonitor Debtor Register, 17 percent of Poles reported that they possess no savings.

BIG InfoMonitor has published the findings from its latest periodic survey. The results indicate that 17% of adult Poles do not have any savings. This figure was 18% last year, and it is projected to decrease to 19% in 2023.

Notably, 33% of the population has savings that are so minimal that they could only last for up to a month in case of job loss.

About 26% of respondents have a savings level that enables them to withstand financial difficulties for more than six months, a statistic that remains unchanged from last year.

„In June, the average gross salary in Poland was PLN 8,800, translating to roughly PLN 6,330 net. The median gross salary in the national economy is PLN 6,883, equating to PLN 4,645 net. This indicates that half of the employed populace earns no more than this amount, while the other half earns at least this much. We consider the financial security buffer as a multiple of the net salary we have saved, generally valued at six months’ net salary. Thus, if we take the median salary into account, the buffer is around PLN 27,870. The study reveals that 4 in 10 Poles have savings that meet this buffer level, indicating they are financially secure,” states Dr. Waldemar Rogowski, Chief Analyst at BIG InfoMonitor.

Savings across different age demographics

The research indicates that individuals under 25 seldom have savings, which is understandable given their often unstable income and reliance on parental support. Differences are observed in older age brackets, although they are minimal, ranging from 80 to 87 percent.

„There is a significant rise in the percentage of individuals whose savings can support them for more than a year – from 8% in the youngest demographic to 19% among those aged 65 and above. Conversely, in these same age groups, the proportion of individuals whose savings last no more than a month decreases from 26% in the youngest demographic to 10% among seniors,” reports BIG InfoMonitor.

More than PLN 5,000? That’s the amount saved by one in four Poles.

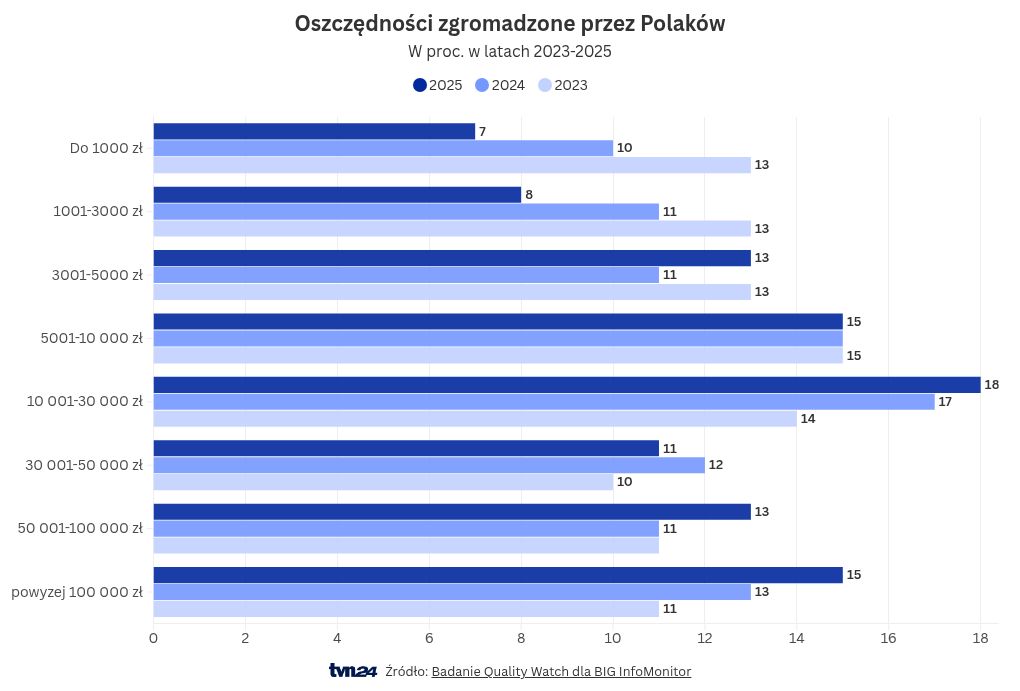

As per a BIG InfoMonitor study, 28% of Poles have a financial reserve of up to PLN 5,000. The largest segment, at 18%, has savings between PLN 10,000 and PLN 30,000. Additionally, 15% of Poles have set aside over PLN 100,000.

„In comparison to 2023 and 2024, there has been a slight increase in the level of savings among Poles. The proportion of individuals with savings not exceeding PLN 5,000 has decreased from 39% in 2023, 32% in 2024, to the current 28%. Meanwhile, the percentage of individuals with savings surpassing PLN 50,000 has risen from 22% in 2023, 24% in 2024, to now 28%,” the report indicates.

Savings for immediate needs

„Poles are increasingly feeling the strain of their personal finances. On one hand, there has been a rise in savings due to increasing wages and a decrease in inflation, reflecting a heightened concern for their financial future. On the other hand, elevated debt levels, particularly in light of high living expenses, present a significant challenge for numerous households. Over the past six months, one-third of Poles had to utilize their savings for essential needs. As a result, many individuals are faced with the challenge of balancing the need to save with the obligation to repay debts,” emphasizes Dr. Waldemar Rogowski, Chief Analyst at BIG InfoMonitor.

According to data gathered from the BIG InfoMonitor Debtor Register and the BIK database, since May of the previous year, the count of unreliable payers has diminished by 116,226 individuals, and the total amount of outstanding debt has reduced by over PLN 194 million. Nonetheless, approximately 2.5 million Poles still owe a total of PLN 86.5 billion in debt.

„This implies that, on average, consumers carry PLN 34,644 in debt, which may be burdensome for those with limited savings who wish to apply them to debt repayment. It is also crucial to note that a reduction in savings dedicated for this purpose could lead to complications in the face of unexpected financial needs and trigger a deeper cycle of debt. We hope that in the near future, the savings of Poles will increase, and the number of individuals facing financial difficulties in our records will continue to decline,” observes Dr. Waldemar Rogowski.