Biznes Fakty

NBP interest rates. How many rate cuts will there be in 2025? Forecasts from PKO BP and Pekao analysts

Analysts at PKO BP forecast another reduction in interest rates for 2025. They suggest that this will happen following the affirmation of a decrease in inflation, stabilization of energy costs, and the outline of the budget proposal for the upcoming year. Conversely, experts from Pekao anticipate two reductions: one in September and another in the fourth quarter of this year. We have gathered the analysts’ projections.

When will interest rates be lowered?

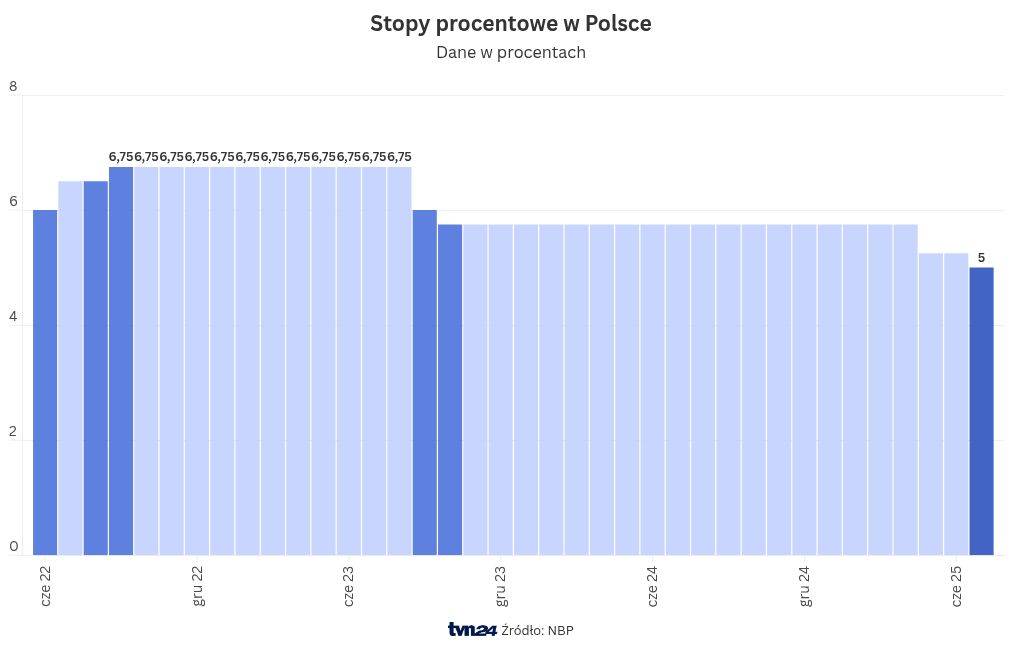

- PKO BP : a 25 basis point decrease in rates is expected in the fourth quarter of 2025, contingent on a confirmed decline in inflation, stabilization of energy costs, and clarity regarding the 2026 budget,

- Pekao SA : a 25 basis point reduction is anticipated in September, followed by another in the fourth quarter of this year,

- Santander Bank Polska : the next interest rate reduction of 25 basis points is forecasted for September 2025,

- Credit Agricole : The Monetary Policy Council is expected to hold off on easing monetary policy until November 2025.

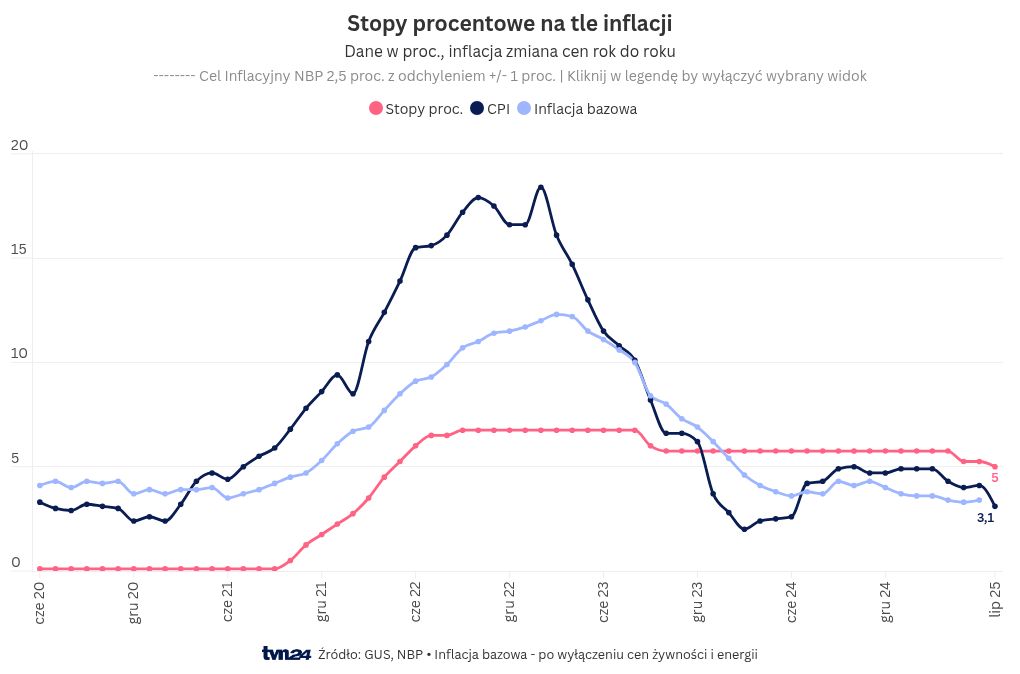

On Thursday, the Central Statistical Office reported that consumer goods and services prices rose by 3.1 percent year-on-year in July 2025, and increased by 0.3 percent compared to the previous month. This figure aligns with the earlier flash estimate provided by the Central Statistical Office.

„The inflation rate for food and non-alcoholic beverages stood at 4.9% year-on-year, unchanged from the prior month. The increase in meat prices (3.1% year-on-year), particularly poultry (11.2% year-on-year), along with oils and fats (8.3% year-on-year), showed signs of slowing. Conversely, the rising inflation in fruit prices (12.2% year-on-year), vegetables (-0.3% year-on-year), and sugar (-27.3% year-on-year) had an opposite impact. In the latter half of 2025, we predict a moderate easing of food inflation, although it will still be elevated,” noted economists from PKO BP.

They also reported that fuel prices experienced a 6.8% year-on-year decrease in July and a 3.5% increase compared to June. They observed that the month-to-month price rise could have been a delayed reaction to the increase in oil prices from June, which extended into July, but acknowledged that the magnitude of the increase was surprising, as market indicators suggested a fuel price rise of about 2% month-to-month.

PKO BP on interest rate reductions

„Apartment maintenance costs rose by 0.9% month-on-month and 4.4% year-on-year in July, resulting in a significant reduction in the annual growth rate for this category from 10.5% year-on-year in June. This decline is attributed to the waning impact of last year’s energy price liberalization (prices in this category saw a 7.0% month-on-month increase in July 2024). The decrease in the index was also aided by lower gas prices (-7.9% month-on-month) due to gas tariff reductions. The reintroduction of the capacity fee (with electricity prices rising by 8.3% month-on-month) and the lifting of district heating price freezes had an opposing effect. We anticipate that electricity price dynamics will not increase significantly before the year’s end (despite the president’s announcement of a potential veto on the law containing a price freeze until year-end),” stated economists from PKO BP.

They believe core inflation decreased to 3.3% in July from 3.4% in June and will likely remain within the 3-3.5% annualized range until the year concludes.

„(…) the drop in inflation in July, in our view, is insufficient to convince the Monetary Policy Council to lower interest rates during its September meeting. A sustainable return of inflation to the target, coupled with certainty regarding energy prices in the fourth quarter of 2025 and clarity on the budget act for 2026, as reflected in the November inflation and GDP projections, will enable the Council to implement one final 25 basis point cut this year,” remarked economists from PKO BP.

Pekao’s optimistic outlook

Analysts at Pekao observed that inflation „would have been lower if not for the delayed effects of the Israel-Iran conflict escalation and the resulting rise in crude oil market prices, along with a one-off spike in fuel prices.” They mentioned that August is expected to bring a drop in fuel prices.

They stressed that following the decline in July, inflation has fallen within the acceptable deviation range from the National Bank of Poland’s inflation target (set at 2.5%, allowing for fluctuations of up to

Źródło