In June, Joanna Tyrowicz, a member of the Monetary Policy Council, proposed an increase of 250 basis points in interest rates. Nonetheless, this proposal was turned down by her fellow MPC members, as announced by the National Bank of Poland.

Since November 2023, Joanna Tyrowicz has been advocating for a rise in interest rates. Up to now, she has suggested a hike of 200 basis points.

During the meeting held on 3-4 June 2025, the Monetary Policy Council decided to maintain all interest rates at their current levels.

At the subsequent meeting on 1-2 July 2025, the Monetary Policy Council (MPC) lowered all NBP interest rates by 25 basis points, bringing the reference rate down to 5.00%.

Interest rates following the July 2025 decision: – reference rate 5.00% per annum; – lombard rate 5.50% per annum; – deposit rate 4.50% per annum; – bill of exchange rediscount rate 5.05% per annum; – bill of exchange discount rate 5.10% per annum.

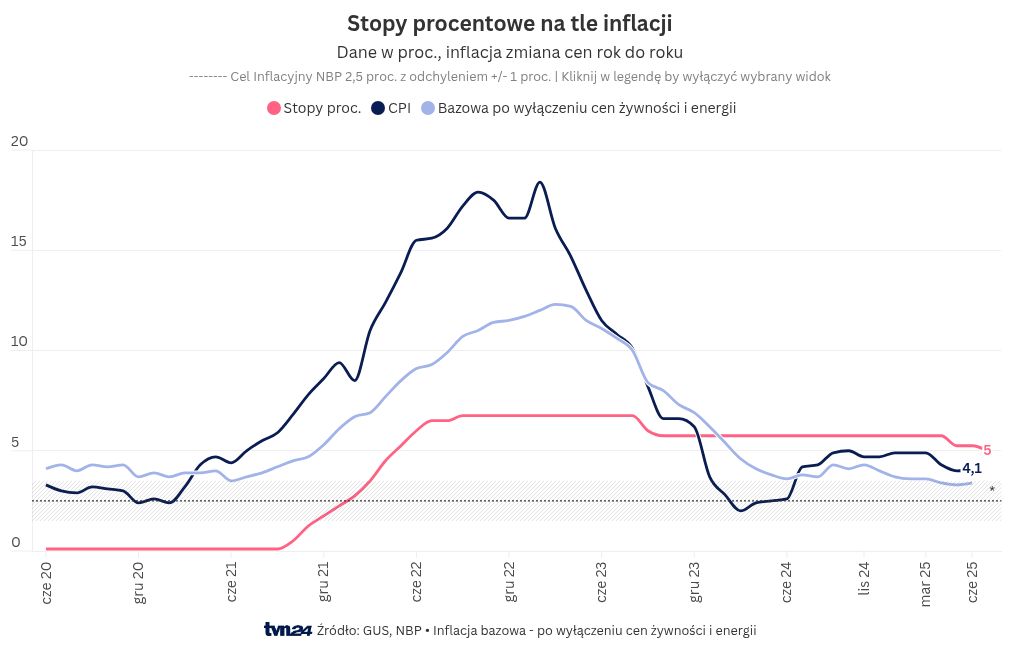

On Tuesday, the Central Statistical Office (GUS) reported that the prices of consumer goods and services experienced a year-on-year increase of 4.1% in June 2025. This figure aligns with GUS’s previous flash estimate. In May, inflation was recorded at 4%.

„The inflation rate for June should be favorable for the Monetary Policy Council (MPC) – there are no indications of inflationary pressure. We believe that the current inflation figures could support another interest rate reduction. During the next meeting in September, the Council may decide to hold off on any action, awaiting the 2026 draft budget. In our view, this document might not indicate a decrease in the fiscal deficit to the extent anticipated by the MPC, potentially delaying decisions on further easing of monetary policy. We anticipate that the MPC will lower rates in November and continue this trend into 2026,” commented economists from PKO BP.

„We foresee (…) that because of the uncertainty surrounding the fiscal policy framework for 2026 and the persistently high level of core inflation, the Council will likely avoid further easing of monetary policy until November this year, at which point – after evaluating the outcomes of the November projection – it is expected to reduce interest rates by another 25 basis points,” noted Jakub Olipra, an economist at Credit Agricole.

„The diminishing risk of inflation (including government announcements regarding the extension of electricity price freezes for households) will encourage the Monetary Policy Council to further reduce interest rates, potentially by at least 25 basis points as early as September. A reduction in the fourth quarter is also likely, with the reference rate dropping to 4.5% by year-end,” analysts from Pekao highlighted.

Twój adres e-mail nie zostanie opublikowany.