Biznes Fakty

There is a decision on interest rates

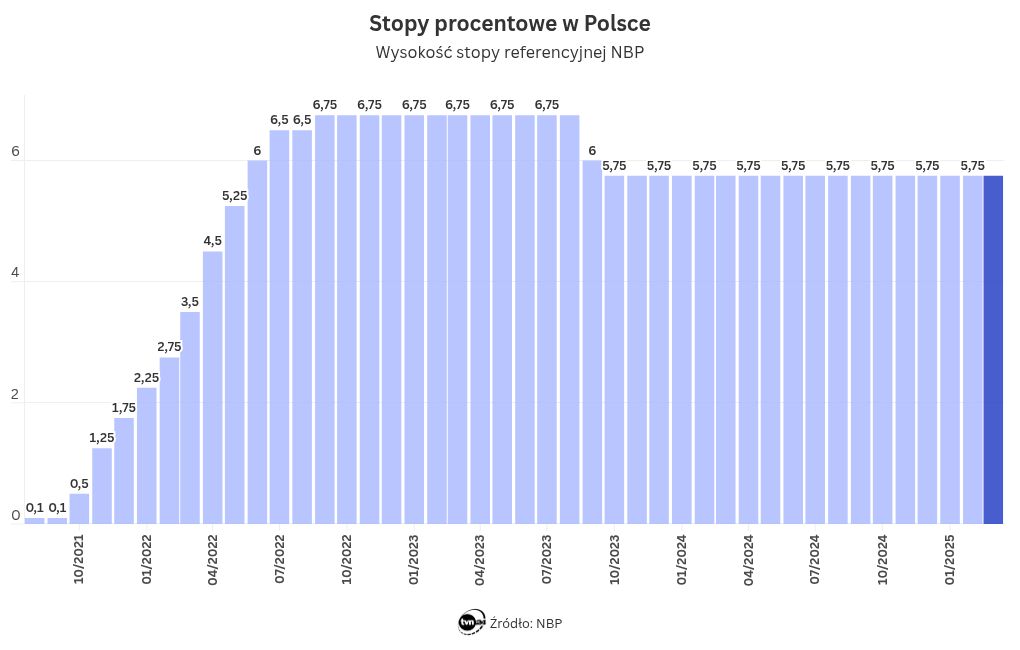

The National Bank of Poland announced that the Monetary Policy Council has maintained the current interest rates. The last modification to the rates occurred in October 2023.

This decision aligned with market forecasts.

Interest rates in Poland

The Council has decided to keep the NBP interest rates steady:

– reference rate of 5.75 percent annually;

– Lombard rate of 6.25 percent annually;

– deposit rate of 5.25 percent annually;

– rediscount rate for bills of exchange at 5.80 percent annually;

– bill discount rate at 5.85 percent annually.

The last alteration to the interest rates by the Monetary Policy Council occurred in October 2023, when they reduced the NBP rates by 25 basis points to the current figures.

A press conference with the President of the National Bank of Poland, Adam Glapiński, is scheduled for Thursday, March 13 at 3:00 p.m.

Announcement from the Monetary Policy Council

„According to the Council, this year, inflation will significantly exceed the NBP’s inflation target. This is attributed to the repercussions of earlier rises in energy costs, hikes in excise tax rates, and charges for administered services, as well as the further removal of energy price caps in the latter half of 2025. In the upcoming quarters, core inflation is likely to remain elevated, coinciding with ongoing economic recovery and a considerable rise in domestic demand,” stated the National Bank of Poland following the MPC meeting on Wednesday.

The Council also mentioned that there is potential for inflation to revert to the NBP target of 2.5% +/- 1 percentage point.

„In the medium term, given the current NBP interest rates and the anticipated gradual decrease in wage growth, inflation should realign with the NBP target. The influence of rising inflation on inflation expectations and wage pressures remains an uncertain factor, particularly in light of increasing demand and low unemployment. Further developments in fiscal and regulatory policy will also affect inflation trends in the medium term,” the NBP articulated in a statement.

However, according to the NBP’s insights, the Council noted that the prevailing wage growth „remains high”. The Council also referenced inflation data from January, which was reported by the Central Statistical Office to be 5.3%. They attributed the rise in inflation primarily to „increases in administered energy prices – notably the partial lifting of energy price controls effective from July 2024 and the rise in natural gas distribution tariffs starting January 2025”, alongside the heightened annual growth rates of food and non-alcoholic beverage prices.

Simultaneously, core inflation is also climbing, primarily driven by the swift increase in service prices, including significant wage growth.

The Monetary Policy Council has also indicated that it has reviewed the inflation and GDP projections for March.

„According to the projection – formulated under the assumption of stable NBP interest rates and based on data available until February 27, 2025 – the annual price dynamics is expected to fall within a 50 percent probability range of 4.1 – 5.7 percent in 2025 (in comparison to 4.2 – 6.6 percent in the November 2024 projection), 2.0 – 4.8 percent in 2026 (compared to 1.4 – 4.1 percent), and 1.1 – 3.9 percent in 2027,” according to the NBP’s statement.

The central bank also indicated that, according to the projection, the annual GDP growth rate is expected to range with a 50 percent likelihood between 2.9-4.6 percent in 2025 (compared to 2.4-4.3 percent in the November 2024 projection); 1.9-4 percent in 2026 (compared to 1.7-4.0 percent), and 1.1-3.5 percent in 2027.

In its statement, the Monetary Policy Council evaluated that inflation in major developed economies is slightly above the targets set by central banks, primarily due to elevated core inflation, particularly in service price dynamics. The Council noted that the outlook for global activity and inflation remains uncertain, especially in relation to changes in trade policies.

The Monetary Policy Council emphasized that its future decisions will be guided by incoming information regarding the inflation outlook and economic activity.

Economists’ insights

„The upward revision of the inflation projection for 2026 is somewhat unexpected. We are likely to receive the projection (and especially the details) this week. This

Źródło