Biznes Fakty

Industry data. It's worse than expected

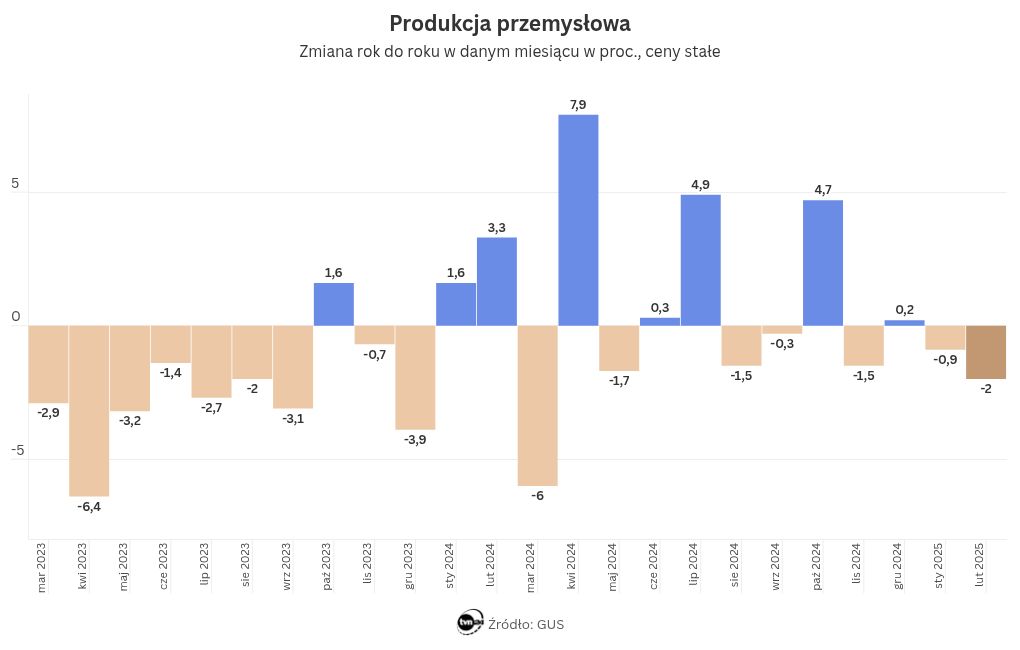

In February 2025, industrial production experienced a decline of 2 percent year-on-year, and on a month-to-month basis, it decreased by 0.4 percent, according to the Central Statistical Office (GUS).

The analysts interviewed by PAP Biznes had anticipated a year-on-year drop of 1.2 percent in production for February, along with a month-on-month increase of 0.1 percent. After adjusting for seasonal effects, the industrial output in February was up by 0.1 percent compared to the same month last year, but down by 0.2 percent from January.

Insights from Polish Industry

Preliminary data indicates a drop in production sold in February across various sectors, including: – a 15.1 percent reduction in the repair, maintenance, and installation of machinery and equipment, – a 7.3 percent decrease in the production of electrical equipment, – a 4.9 percent decline in beverages, – a 4.8 percent drop in motor vehicles, trailers, and semi-trailers, – a 3.6 percent reduction in machinery and equipment, – a 2.3 percent decrease in the extraction of hard coal and brown coal (lignite), – and a 2.2 percent decline in the production of rubber and plastic products. Conversely, growth in sold industrial production was noted in the following areas: – a 15.5 percent increase in metal production, – a 10.2 percent rise in the manufacturing of other transport equipment, – an 8.7 percent increase in waste management and recovery of raw materials, – an 8.1 percent rise in the generation and supply of electricity, gas, steam, and hot water, – and a 6.4 percent increase in the production of computers, electronic, and optical products.

Remarks from Economists

„The February figures from the Polish economy have been underwhelming thus far: industrial production slipped by 2% year-on-year (with continued stagnation visible in the detailed chart), and construction output remained unchanged. The latter was affected by weather conditions, but that explanation does not apply to the industrial sector. External demand continues to be weak. Given the available data, there is no indication of accelerated GDP growth at the start of the year,” stated Bank Pekao in their commentary.

„February did not bring any significant changes in the industry, although the latest PMI offers optimism for the future. The construction sector’s February performance was slightly below expectations, but the overall trend suggests that the worst may be behind us. Investments are showing improvement,” wrote analysts from mBank.

„While there is a recovery occurring in global industry, it is not reflected in Germany and our region. In this cycle, we are relying on domestic demand (consumption and public investment), but with one engine—exports—still underperforming, the cyclical recovery of Polish industry is likely to be sluggish. For the time being, we are continuing to mirror stagnant trends seen in Czech and German industries, which is why the fiscal stimulus from Berlin is crucial, though it may only yield significant improvements in Polish exports and production by 2026,” commented economists from ING.