– For several months, I have been convinced that the initiation of interest rate reductions in Poland might occur around the transition from the first to the second half of the year, stated economist Marek Zuber during the „Fakty po Faktach” segment on TVN24.

– I am hopeful that such an opportunity will arise in June or July. However, there are still numerous uncertainties today, Zuber added.

At the Monetary Policy Council’s meeting in March, there was no adjustment to the interest rates set by the National Bank of Poland. The primary interest rate remains at 5.75%. The Council highlighted that future decisions will be influenced by incoming data regarding inflation forecasts and economic performance. The current interest rates have been upheld since October 2023.

The economist noted, „We are dealing with the most unpredictable Monetary Policy Council we have encountered to date.” He also recalled that prior to initiating the cycle of increases, Adam Glapiński, the President of the National Bank of Poland, had assured that there would be no hikes in interest rates.

Zuber pointed out that „during the most recent press conference, Adam Glapiński demonstrated that interest rates do not significantly affect investments.” – Naturally, they do – he asserted. – Once again, we witnessed such social engineering. There is indeed a substantial issue regarding investments in Poland. A very serious challenge began in 2016 when the predictability of the economic environment deteriorated – he clarified.

He added that „among the various factors influencing investments, interest rates were not the most crucial, primarily because there were no substantial investments.” – However, one cannot conclude from this that interest rates, the cost of borrowing, and what entrepreneurs pay for loans do not influence investments – assessed the guest on „Fakty po Faktach”. – What is particularly interesting is the other side of the argument – as we are well aware, there are currently two perspectives within the Monetary Policy Council regarding monetary policy – at least part of this opposing view shares a similar sentiment. Therefore, this argument seems to prevail among Council members today. I, however, fundamentally disagree with this – Zuber added.

– If we assume that interest rates have no effect on investments or on our purchasing willingness, it implies that monetary policy, or the mechanism of monetary policy transmission, including changes in interest rates, is essentially meaningless – the economist explained.

When asked what indicators Poles should keep an eye on while anticipating lower loan installments due to decreased interest rates, Zuber highlighted inflation metrics – „This inflation needs to begin declining,” he clarified.

– What we have seen after February is notable; we had an initial reading of 5.3% in January, which has now adjusted to 4.9% in February – of course, the January inflation is also being revised based on the changes in the basket – he added, explaining that we now need to wait at least two months to determine if this inflation will genuinely begin to decrease with the new basket.

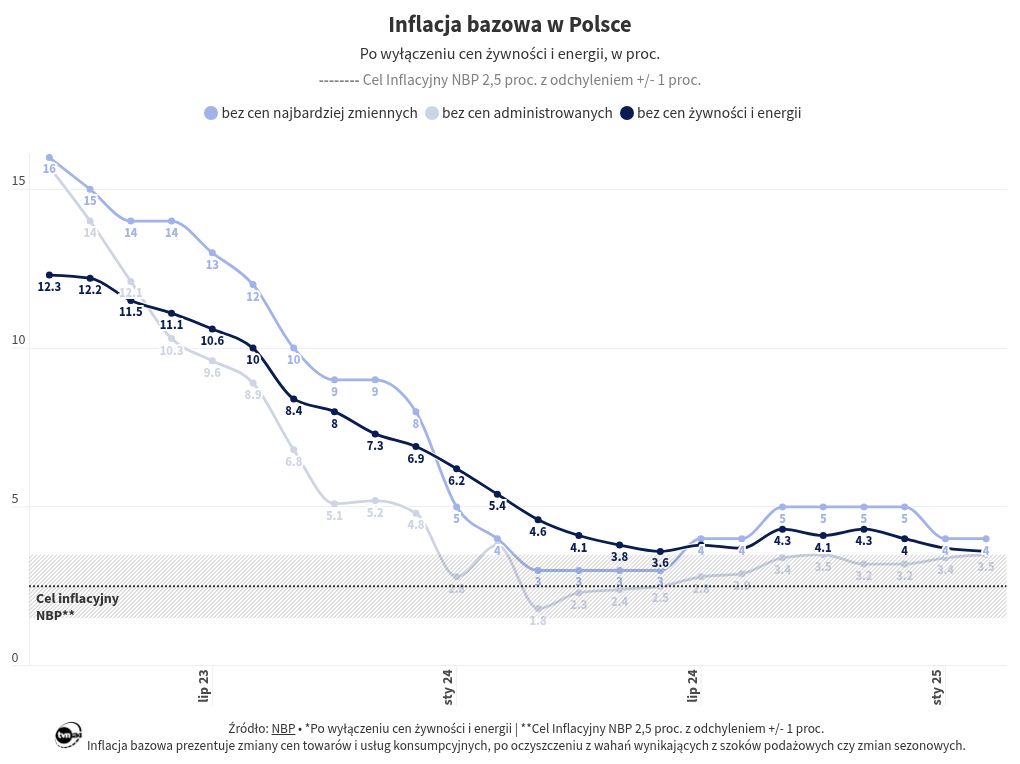

In March, the NBP released figures regarding core inflation for February 2025. These figures indicate that core inflation, excluding administered prices (which are state-controlled), was at 3.5%, compared to 3.4% the previous month. Core inflation, calculated by omitting the most volatile prices, was 4.9%, up from 4.8% the month before. Core inflation, excluding food and energy prices, registered at 3.6%, slightly down from 3.7% prior.

– We are facing another challenging period this year, commonly referred to as the unfreezing of energy prices – Zuber added. – We are uncertain if that will occur. However, I believe that even if the government were to announce, for instance in a month, that these prices will no longer be frozen, we will experience a peak in inflation during the first quarter – he remarked, noting that another significant factor is the ongoing dynamics of wage growth.

– If we do not encounter any issues over the next two months, that is in April and May, and if inflation starts to decline, including core inflation, which excludes energy prices and carriers, then I would advocate for lowering interest rates for the first time in June – explained the guest on „FpF”.

Twój adres e-mail nie zostanie opublikowany.